The definition of investment fraud varies depending on the entity providing the definition. For instance, according to the FBI, the illegal sale or purported sale of financial instruments constitutes investment fraud.

A more accurate definition of investment fraud would have to be wider, however, covering every deceptive practice that perpetrators use to push investors into decisions that will result in the transfer of their hard-earned money into the pockets of the scammers.

Such practices include but are not limited to:

- Promises of great/guaranteed returns, coupled with fictitious opportunities.

- Misleading information.

- Deals involving unregistered securities.

- Various complex investment strategies purport to have figured out the markets or to have identified profitable mathematical formulas.

- Fictitious or misrepresented products.

The world of investment fraud is very dynamic and flexible. Scammers are very creative in developing new ideas, and they can adapt to various events, such as technological developments, on the go. State securities regulators deal with such scams all the time, and they have compiled lists of the most common/popular types of investment fraud.

How to Avoid Investment Scams?

Be highly suspicious of any unsolicited offer. To be safe, you should ignore all such emails, cold calls, etc.

- Make sure that the entity offering you the investment opportunity is registered in your jurisdiction.

- Take a look at the file that the regulator has on this entity. Make sure that the website that the regulator has on file does indeed match the website of the broker.

- Steer clear of any investments peddling unrealistically high returns or quick profits. Be aware that there are no risk-free investments. In the real world, the higher the potential return on an investment, the riskier it is.

- Be wary of urgency and high-pressure promotional tactics. Scammers use urgency to prevent you from researching their scheme and uncovering its true nature. An investment that you cannot research is not worthy of your attention.

- Check for written material about the investment and the company offering it. If someone tells you that they do not have such material, walk away from the deal.

- Does the person/company offering you the investment have an adequate license? Never conduct any business with unlicensed entities.

Never be shy to ask questions before you commit to an investment. It is your right to know how you invest your money. Have a policy of zero tolerance toward everything even slightly suspicious. Remember: fraudsters do not want you to do your research.

Below are some common types of Investment Fraud.

Promissory Notes

Governments around the world have addressed the ongoing economic crises through stimulus packages and quantitative easing. This approach has created an environment of low and negative interest rates, making it impossible for the rank-and-file saver to earn passive revenue.

In these circumstances, promises of high-interest rates are impossible to resist for many. Promissory notes represent the perfect vehicle for scammers to hook such investors.

A promissory note is a written commitment to pay a set amount of money on demand or at a specified time in the future. Promissory notes are interest-bearing investment vehicles.

Like initial public offerings (IPOs), promissory notes allow companies to raise capital. Most businesses only offer promissory notes to institutional investors or high-profile, sophisticated individual investors.

The sale of promissory notes to retail investors is a complicated affair if done legally. Only entities that possess a securities license or a registration from the securities agency of their state, can sell such financial instruments to retail investors.

If the salesperson trying to sell you promissory notes does not have such credentials, you are dealing with a scammer.

Furthermore, the general public only has access to promissory notes that the SEC has registered. Some notes may be exempt from the registration requirement, and this is the legal loophole that scammers turn to their advantage.

Short-term promissory notes, with a maximum duration of nine months, may not have to be registered. It makes sense to be suspicious and cautious of any investment involving such short-term notes. It also makes sense to thoroughly research the variables of the investment and the people promoting it, regardless of the duration of the promissory notes.

When researching the salespeople behind the investment, be mindful of the following.

- If the interest they peddle seems too good to be true, it is a scam.

- Do not use a website as a decisive factor in forming an opinion about someone.

- Search the internet for feedback on the investment services you are researching. Victims of investment fraud are often vocal, warning would-be victims to stay away from the trap.

- Consider the channel through which you first came into contact with the investment service. People who contact you through unsolicited emails with offers too-good-to-be-true are scammers.

- Be highly suspicious of offshore investment companies. They operate outside the legal jurisdiction that can protect you.

Advance Fee Fraud

Advance fee schemes are as old as the internet itself. Over the years, they have taken various forms, some blatant, others more subtle. They are all after your hard-earned money, however, regardless of the finesse of the perpetrators.

The problem with advance-fee scams is that some may even pass as legal, provided they adhere to certain conditions.

Through an advance fee scam, the victim pays a sum of money to the scammer, expecting something more valuable in return. This something can be a product, a service, an investment opportunity, etc. Indeed, the famous “Nigerian email scams” belong in this category of fraud as well.

The most dangerous form of the scam has perpetrators charge their victims a “finder’s fee” for locating a loan provider, for instance. Having paid the fee, the victims learn too late that they are ineligible for financing. The problem with this scam is that it is legal, as long as there is no proof that the perpetrator never intended to deliver the service to the client.

To avoid such scams, listen to common sense.

- A legitimate business will not have you making transactions with cash on the street corner.

- Research the business before you send it any money. Do not deal with entities working out of a post office box without a proper physical address.

- Never sign a non-circumvention agreement. Scammers use such legal artifices to threaten their victims, should they consider turning to the authorities.

Pyramid Schemes

Pyramid schemes require their victims to pay in and then recruit others. The more subsequent victims a particular participant manages to get into the fold, the higher his/her purported reward will be.

Scammers may build pyramid schemes around products and franchises. Typically, those who join the scheme, get the right to distribute a product. The real profits, however, come from getting others to join. Eventually, every pyramid scheme collapses, and lower-level members are left holding the bag.

At its beginnings, a pyramid scheme will pay some of its members as claimed, from the investments of those who signed up later. This way, it builds “prestige,” and a “bait” to lure in others.

- Pyramid schemes are relatively easy to identify as such. Any scheme that requires/rewards you to bring in more investors is a pyramid.

Ponzi Schemes

The close relatives of pyramid schemes and Ponzi schemes focus on investments. They promise higher returns than traditional investment vehicles and pay their investors from the money subsequent victims deposit. Eventually, the scheme inevitably collapses under its weight.

Most Ponzi schemes usually fall apart earlier than they would from a lack of mathematical sustainability, as their perpetrators make off with the funds.

The scam bears the name of a certain Charles Ponzi, who ran such a scheme in the early 1900s, guaranteeing 50 percent returns on postal coupon investments.

Pump-and-dump Investment Fraud

Pump-and-dumps have become widely known over the last few years due to Hollywood movies and the cryptocurrency industry. At the peak of the ICO craze, it became standard practice for scammers to launch a new coin, quickly pump up its value through shady promotional practices, and then exit with the proceeds.

Stock-based pump-and-dumps are slightly more sophisticated scams, but the MO behind them is quite similar. The scammers buy up low-priced shares. They then drum up fake news and hype, which – coupled with the buy-up efforts – drive the stock price higher.

At the opportune moment, they bail out, dumping the shares and crashing the price, leaving their victims holding the bag.

Cold-calling people and convincing them to buy into a “pink sheet” stock is one way scammers can boost stocks of their choice. By convincing people to buy such stocks, they create artificial demand, thus inflating the price. Unsolicited emails and text messages have given fraudsters new tools to power their pump-and-dumps.

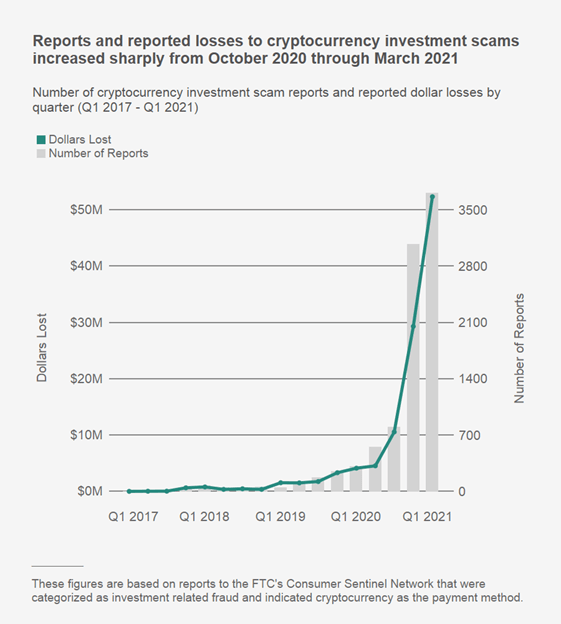

Cryptocurrency Investment Fraud

Flying under the radar of regulators, within a legal grey area, cryptocurrencies represent the perfect vehicles for fraudsters.

Until not so long ago, thieves who made off with another person’s Bitcoin could rest assured the victim would not be able to pursue them in any way.

With the advent of firms like CNC Intelligence Inc., however, cryptocurrency thieves can no longer rest on their laurels. The nature of blockchain technology lends digital assets well to forensic investigation and tracing. Those possessing the right tools, expertise, and connections can now trace stolen crypto funds and identify the thieves. Working together with law enforcement, they can prosecute the perpetrators and recover the funds.

The only way to invest in cryptocurrencies reasonably is to understand how they work. Even so, many people fail to see the warning signs various projects carry. Many get emotionally attached to projects and thus convince themselves of their legitimacy.

Since the laws that could protect investors do not yet exist in the cryptocurrency space, this realm remains a highly speculative one, carrying a high risk of loss.

Offshore Investment Scams

Such offshore scams aim to take advantage of the legal ambiguity that exists for securities sold outside the US as well as for cryptocurrencies.

According to “Regulation S,” US companies do not have to register securities that they sell exclusively to investors outside the US. Some scammers have no qualms about selling such securities to US customers as well, in defiance of the law.

Given the lack of legal oversight, such offshore securities offer ideal opportunities for scammers to fleece their victims.

The offshore nature of these scams means that US law enforcement agencies cannot investigate the fraud, and deal with the perpetrators as they would normally.

The rise of social media has created yet another channel for scammers to fleece unsuspecting victims. People will readily share personal information through this channel, unaware of the potential consequences. This way, they open themselves to a wide range of investment scams.

As technology advances, investment fraudsters find newer and newer pastures to scam the gullible. Always be on the lookout for deals that seem too good to be true. No one will ever give you money for free or let you in on a good deal, for the heck of it.

Legitimate investments take time to yield results. Those telling you otherwise are only out to get your money.

What to do if you have fallen for an Investment Fraud?

- Document everything, and make sure to preserve as much evidence as possible

- Report the fraud to the relevant regulator authorities in your jurisdiction and the jurisdiction of the people or entities that committed the fraud

- Report the fraud to local and national law enforcement

- Consider if hiring a law firm, investigation or recovery company makes sense for your case. Depending on the amount you lost and the details of your case it may or may not be worth it to get professional help. Before you hire anyone, make sure to do your due diligence on who they are and ensure that they are legitimate.

- Report the fraud to your bank and any other financial institutions involved. If you hire a recovery company, you should consult with them on exactly how to report the fraud to your bank’s dispute or fraud team in order to maximize your chances of recovering your funds.

- Be wary of anyone who “cold calls” you. Recent victims of scams are often called by the same scammers pretending to offer to “recover” their money, so be suspicious of anyone who calls you out of the blue.

We offer complimentary consultations to determine if our Asset Tracing, Recovery Assistance, and Intelligence Services are suitable for your case.

When you comment, your name, comment, and timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.

i inventor looking for real company that write medical grants very site i go to list of dummy companies saying writer firm its scam or there they company shows up something else its not right even with some grants are scam what is this mess we are living in .lucky double check there work and company

Hi Bryant. If you have a question whether a specific company is legitimate or a scam, please feel free to ask us.

Is Powerball winner Mavis Wanczky giving money to people in need of help?

No, it’s a scam, unfortunately.

If the CNC cannot help me recover cash money to who can help me

Dear Guadalupe R Gonzales,

CNC Intelligence can assist not only with tracing cryptocurrency transactions but also with recovering funds from wire transfers and credit card transactions. However, recovering physical cash money lost in a scam remains beyond our expertise. In such cases, we recommend contacting your local law enforcement agency and consulting with a lawyer experienced in financial fraud for guidance. If you need assistance with cryptocurrency, wire, or credit card-related scams, feel free to reach out to us.

Best regards,

CNC Intelligence Team