This article summarizes the 2025 Coinbase data breach and the online discussions surrounding the event.

This article summarizes the 2025 Coinbase data breach and the online discussions surrounding this event. It will go over the facts on the ground, the role Know Your Client regulations had in the data breach, the arguments postulated by anonymity enthusiasts against KYC, and the counterarguments of regulation advocates.

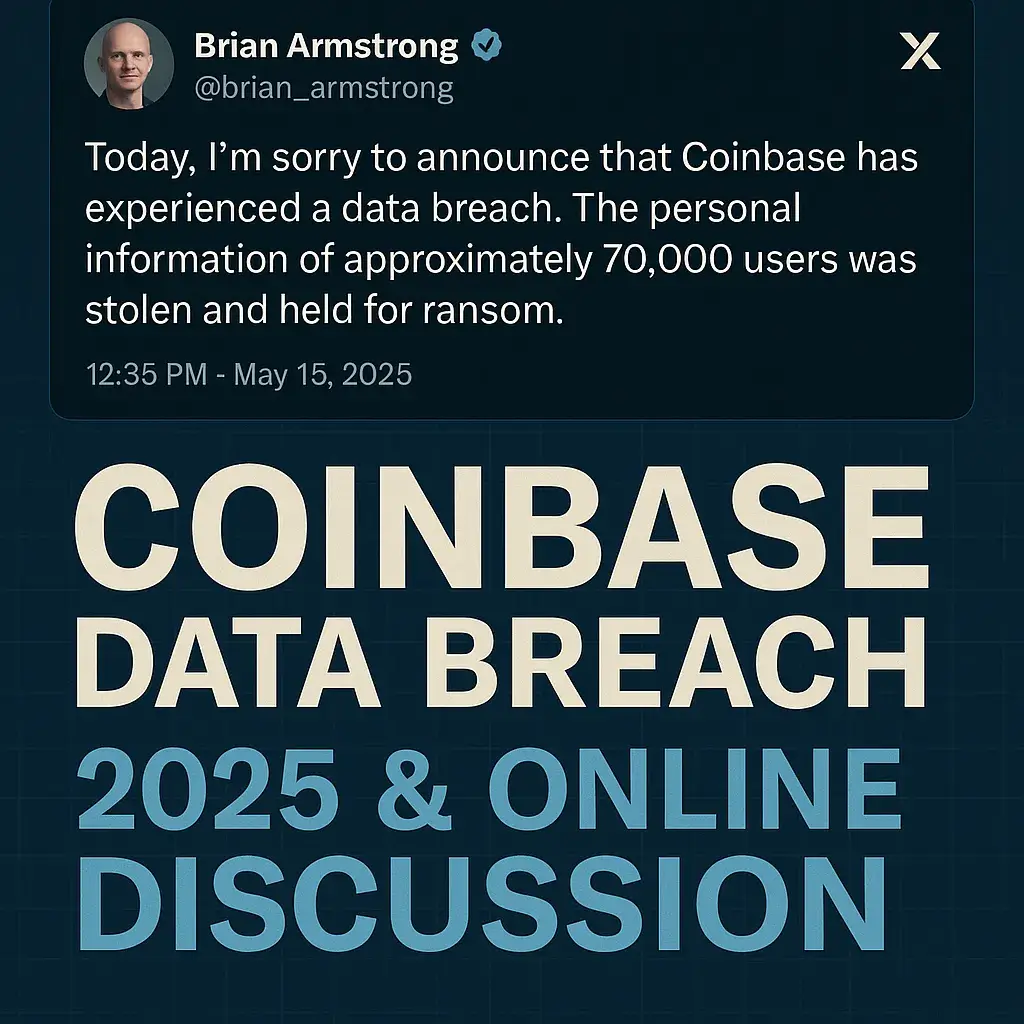

TL;DR: On May 15th, 2025, Coinbase CEO Brian Armstrong came forward on X (formerly Twitter) to publicly announce that the company had suffered a data breach, where the Personally Identifiable Information of around ~70.000 users had been stolen and held for ransom. This event kickstarted renewed online discussions over the utility and legitimacy of Know Your Client (KYC) financial regulations, which compel cryptocurrency companies to gather and store the personal information of their users to help governments fight crime. As the online debate rages, this article aims to explain the arguments of both sides and elaborate on why, in our opinion, KYC is not your enemy but your greatest friend.

Even the mightiest fortresses have their weaknesses. Be they made of solid stone like castles of old, complex earthworks like in the First World War, or the wireless networks and lines of code of modern cybersecurity, all systems, if you’re crafty enough and have plentiful resources, can be attacked and eventually breached.

But if fortresses can fall, why bother making them in the first place? Why did the Greeks and Romans, medieval English and French, Renaissance Italians, and industrial era Germans bother with their castles, forts, and trenches? Why do we bother today with cybersecurity?

Because if we want true online freedom, we must protect it. We build walls around what we hold dear. And a huge part of this protection is knowing exactly who is inside the fortress, both the soldiers manning the walls, and the people they defend.

In light of the recent data breach suffered by Coinbase, numerous online debate spaces flared up in heated arguments on whether KYC (Know Your Client) and AML (Anti-Money Laundering) regulations are justified or not, with numerous anonymity advocates taking to social media to blame these regulations for the attack. Roger Ver, a controversial figure in the crypto investment space, once tweeted, “KYC requirements put every crypto user at risk. When an exchange is hacked and KYC info is leaked, thieves know exactly who the crypto whales are, and where they live, making them unsafe in their very own homes.” This perspective, especially in the immediate aftermath of the data breach, was echoed by numerous users across the net.

But is KYC/AML regulation truly the problem? Or does the issue lie somewhere else? Is absolute anonymity truly the safest option? And is it even desirable in the modern internet? This article aims to answer these questions and present our arguments in the eternal debate of anonymity vs regulation, using the Coinbase data breach as a case study.

Inside the Coinbase Data Breach: An Insider Betrayal

Hackers and scammers come in all shapes and sizes. While we typically imagine hooded guys in dark rooms, surrounded by monitors and wearing Guy Fawkes masks, these internet scoundrels vary widely in skills, resources, geographical location, and methodologies. And as such, they can strike in ways we sometimes do not expect.

On May 15th, 2025, days before becoming the first cryptocurrency company to join the S&P 500, the CEO of Coinbase, one of the leading cryptocurrency exchanges in the world, came forward on X (formerly Twitter) to publicly announce the company had suffered a substantial data breach, where attackers had stolen tens of thousands of Personally Identifiable Information (PII) documents from around ~70.000 users. These attackers had also sent an email demanding $20 million dollars in crypto as ransom, threatening to make the files public should the company not comply.

The interesting part? There was no cyberattack on their infrastructure, nor was there a hacker finding and exploiting vulnerabilities within Coinbase’s digital systems. No advanced malware was reportedly involved. Instead, the attackers resorted to the oldest trick in the book: Find someone inside, and bribe them.

And it worked.

A customer support employee from an overseas office opened the proverbial gates of the castle, and the attackers rushed in to abscond with the PII documents of, as of the most recent reports at the time of writing, 69.461 users. This information included, among other things, their full names, home addresses, phone numbers, email addresses, pictures of their government-issued IDs, their Coinbase account balances, and their transaction history.

In other words, a gold mine for scammers and identity thieves.

To their credit, Coinbase’s response was swift and decisive. They filed reports with the US Securities and Exchange Commission, kickstarting a law enforcement investigation on the matter, and rather than pay the $20 million dollar ransom, the CEO pulled an “Uno Reverse Card” on the attackers and offered that same sum as bounty for anyone who provides information that leads to their arrest.

Furthermore, Coinbase fired all compromised personnel, reported them to law enforcement, and pledged to rework their internal security and reimburse all users targeted by social engineering attacks as a result of this data breach, a sum that, according to company estimates, could reach between $180-400 million.

Now, the good news is that no wallet passwords, private keys, or funds were stolen in this data breach. The information the attackers absconded with is limited only to the ~70.000 users’ PII documents, which is still a very big deal, but it could have been much worse.

Meanwhile, plenty of online arguing flared up over whether Coinbase did anything wrong or not. Hundreds of cybersecurity experts and amateur analysts have already taken to Reddit, Twitter, and other social media to discuss the data breach, with heated back-and-forth arguments erupting in practically all posts and threads. Harsh criticism towards KYC regulation has been a staple of most of these discussions, and we’ll address this subject in particular down below.

Victim Impact: Consequences of the Coinbase Data Breach

The Coinbase data breach, like any other instance of stolen personal information, poses several risks for those affected, which extend far beyond the theft itself. If you’ve been affected by this data breach or any others in the past, here’s a quick summary of what to look out for:

Targeted Hacks, Scams, and Social Engineering:

With your personal information at hand, scammers can attempt to impersonate Coinbase customer support, crafting highly believable emails, texts, and even phone calls to deceive users into “securing” their funds by transferring them to fraudulent wallets. Alternatively, they might attempt to steal access to your wallet via SMS 2-factor authentication, using SIM-swapping attacks on your phone to gain access.

For high net worth users, meanwhile, the potential risk might, unfortunately, be higher, as the PII documents also include details such as their account balance, home address, and photo ID. This information could, if the necessary resources and know-how are available, be used by organized criminals to physically target users, be it to extort money at gunpoint, or kidnap them or their loved ones for ransom. The probability of this happening is very low, of course, but the possibility is there.

Identity Theft Risk:

As government-issued photo IDs were also included in the data breach, affected users might find themselves affected by identity theft, as criminals could potentially use this information to open fraudulent bank accounts and crypto wallets, apply for loans, or impersonate you while carrying out further scams on other people.

Staying Safe After the Coinbase Data Breach: Precautions Moving Forward

Whether you’ve been affected by the Coinbase data breach or not, we greatly encourage you to take these steps to improve your wallet security:

Use Multi-Factor Authentication tools: Hardware-based security keys like YubiKey and authenticator apps like Google Authenticator are great tools to secure your accounts. Wallet app biometric scans are also highly recommended. However, avoid SMS authentication at all costs, as they are highly vulnerable to SIM-swapping attacks.

Change your phone number: If your phone number was leaked, the odds of receiving suspicious calls and being targeted by SIM-swapping attacks have increased exponentially. Changing your phone number instantly solves this issue.

Get a new photo ID: Having a compromised photo ID as your current identification document leaves the door wide open for identity theft. We greatly recommend you get a new ID, with a new photo and barcode.

Change your passwords: As a just-in-case measure, make sure to regularly change the passwords of all your accounts. Using password managers like Bitwarden and 1Password is also a good idea.

Keep a close eye on your accounts: Regularly check for suspicious logins and their IP addresses, as well as your transaction history. If your wallet service allows for it, enable transaction notifications to keep you up to speed with all fund movements.

Beware of phishing: Never click on weird links or share any credentials in reply to unsolicited emails or messages. Verify all communication through official channels.

Store funds in secure wallets: Move any funds you’re not actively using to a cold storage wallet service or hardware device, and funds you use regularly to highly secure, non-custodial Multi-Party Computation wallets.

Google search wallet addresses before transactions: If you are about to send funds to someone you don’t know, Google their wallet address. Crypto scam investigators regularly expose fraudulent addresses for all to see.

Regulation vs Anonymity

News of the Coinbase data breach immediately kick-started renewed discussions on whether KYC and AML regulations are necessary or desirable in the crypto environment. KYC in particular came under fire from anonymity advocates, who, echoing perspectives like that of Roger Ver, believe that the whole point of cryptocurrencies is to allow for safe transactions between completely anonymous users, and regulation creates unnecessary risks.

So, what exactly is KYC?

In short, Know Your Client regulations compel companies to request their users’ Personally Identifiable Information upon creating their accounts, and to keep the files in safe storage in case a law enforcement investigation requires it. The goal of KYC, therefore, is to prevent fraudulent and criminal use of wallets for nefarious purposes, deterring criminals from using crypto, and helping to bring bad actors to justice.

However, it is more than evident that any repository of PII files will be an attractive target for hackers, as this wealth of information, if stolen, can be easily exploited to target users. Anonymity advocates here will point out, correctly, if we’re being fair, that if these repositories never existed, there would be no information to steal, and thus the safety of users would be guaranteed. Without repositories, there is no risk of data breaches, and thus users, in theory, wouldn’t have to worry about hackers, scammers, and identity thieves targeting them by exploiting their PII.

But, on the flip side, it is this very anonymity that makes cryptocurrencies attractive for criminals of all shapes and sizes. The past decade and a half has seen an increase in the use of crypto for tax evasion, money laundering, drug dealing, and human trafficking, among many other illicit activities (Remember Silk Road?). Terrorist groups like ISIS, Hamas, and Hezbollah are known to use shady crypto services to finance their operations, mainly through anonymous donations, and it’s also widely known that certain infamous rogue States like North Korea use crypto to skirt international sanctions.

All this, of course, doesn’t mean that the crypto ecosystem is exclusively a nest of crime and terrorism. Certainly not! But if cryptocurrencies are to remain a big part of the worldwide financial system, and keep growing and thriving as they currently are, then governments need to trust the crypto market. And for governments to do so, they need reassurances that cryptocurrencies will not be used as a means to evade the law.

But if anonymity enables crime, and regulation makes data vulnerable, then what do we do? What is the middle ground?

Security Through Compliance: Rebuilding Trust After the Coinbase Data Breach

Know Your Client regulations are far more useful than they seem at first glance. The problem, however, is not the regulations themselves, but the handling of the PII data repositories and the security measures companies adopt to protect them. Of course, no system is ever perfect; even the mightiest fortresses have their weaknesses. But shoring up those weaknesses can go a long way.

In order for KYC to not be a potential liability, companies must gain and keep the trust of their user base, and this is achieved through strict following of security protocols, both in cyberspace and the physical world. This can be achieved through:

- Robust cybersecurity systems.

- Regular security training for employees.

- Thoroughly vetting new hires.

- Compartmentalizing data repositories to contain breaches.

Coinbase’s data breach is important precisely because it shattered their users’ trust, and this sent shockwaves across the entire crypto ecosystem. But if lessons are learnt, changes are made, and new systems are employed, then this trust can be rebuilt. At the end of the day, even the staunchest anonymity activist actually wants just one thing: personal security. So if the right incentives are in place, KYC compliance will be the safer alternative.

All in all, KYC is your friend. If you ever happen to be a victim of a scam or hack, and your funds end up in the hands of bad actors, then law enforcement can use the KYC data of the attackers to put them in jail. Furthermore, companies that are KYC certified will most likely protect your funds far, far better than those that are not, both against external threats and themselves. Fraudulent crypto companies rarely, if ever, comply with any regulations, so if you see an ad for an unregulated wallet, keep your distance.

Conclusion: What the Coinbase Data Breach Teaches Us

If we want true online freedom, we must protect it. Protect it from those who wish to oppress, but also from those who take advantage and use it for crime.

Know Your Client and Anti-Money Laundering regulations exist precisely for this reason. To rein in the Wild West of early cryptocurrencies and clean up the ecosystem from both petty wrongdoers and organized criminals. To make the crypto market a safe place that governments can trust, and thus allow it to thrive under the watchful eye of competent authorities. To prevent terrorists and rogue States from anonymously financing their operations, and thus allow crypto to contribute, in an undeniably positive way, to the worldwide economy.

The Coinbase data breach may not be a before-and-after scenario for cybersecurity, but it certainly reminded us of how crafty and resourceful online attackers can be. Lessons should be learned, changes should be implemented, and steps should be taken to not only prevent this from happening again, but also mitigate the damages should the worst come to pass. It is completely understandable that KYC regulations came under fire after this theft, but it is of critical importance not to lose focus on the bigger picture.

Anonymity was great when crypto was young. But if we want this market to grow, thrive, and be truly remarkable on the world stage, then the best way to do so is by building a fortress. A fortress of checks, balances, and trust.

Bibliography:

Blockchain Unmasked (2025). “Coinbase’s Breach: Reading Between the Lines”.

Brian Armstrong (2025). Public announcement on X.

Coinbase (2025). “Protecting Our Customers – Standing Up to Extortionists”.

US Securities and Exchange Commission (2025). Coinbase Global Inc. Form 8-K report.

Reuters (2025). “Coinbase warns of up to $400 million hit from cyberattack”.

BleepingComputer (2025). “Coinbase says recent data breach impacts 69,461 customers”.

We offer complimentary consultations to determine if our Asset Tracing, Recovery Assistance, and Intelligence Services suit your case.

Your name, comment, and timestamp will be public when you comment. We also store this data, which may be used for research or content creation per our Privacy Policy. By commenting, you consent to these terms.