This article focuses on CNC Intelligence’s Bitcoin and Cryptocurrency Tracing and Recovery services and how they work.

As cryptocurrencies slowly but surely move past the status of online collectibles/interesting financial experiments, scammers, thieves, and hackers redouble their efforts to siphon digital currency out of the pockets of rightful owners.

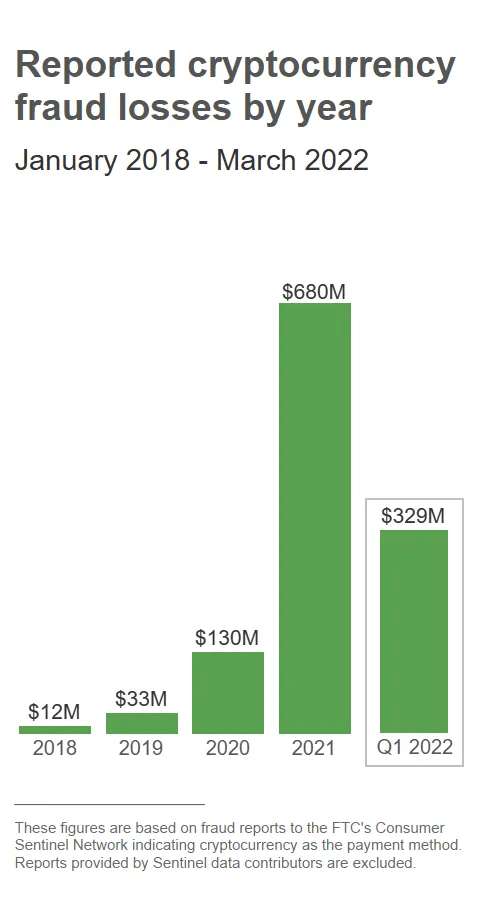

In 2018, studies estimated that within the crypto sector, legitimate actors lost some $12 million worth of digital assets to theft.

That problem has likely grown more acute since as can be seen in the below graph:

The proliferation of crypto-related crime has boosted the demand for solutions to trace stolen digital assets, identify thieves, and recover funds.

“Regular” hackers, thieves, and cybercrime perpetrators only represent the tip of the iceberg when it comes to crypto-related fraud.

Experience has shown that improper transfers from bankrupt debtors through judgment- and arbitration award creditors are also channels of crypto fraud.

The cryptocurrency industry can only step onto the path of sustained growth through mass adoption if reliable mechanisms exist to support private dispute resolution and cryptocurrency tracing and recovery.

The distributed ledger technology most digital assets use, coupled with the ambiguous legal status of this emergent asset class, hinders the implementation of reliable mechanisms.

For effective Bitcoin and cryptocurrency tracing and recovery, the asset should legally qualify as property.

While some nations have moved ahead and granted legal definitions to cryptocurrencies, others have not yet bothered.

The resulting global patchwork quilt of laws governing the ownership of digital assets has, therefore, turned digital asset recovery into an exercise in legal acrobatics and liaising with various law enforcement agencies.

With that in mind, it is clear that any entity purporting to offer reliable cryptocurrency tracing and recovery services needs to possess a solid legal team as well as liaising abilities in addition to the raw technical capabilities required to trace digital assets.

How Does Cryptocurrency Tracing and Recovery Work?

Let us take a look at the procedural steps of crypto-asset tracing and recovery.

- Investigating the movement of the crypto assets.

- Acquiring information on the perpetrators.

- Initiating recovery efforts/legal action.

Investigating the Movement of Crypto Assets

Throughout this phase of the recovery operation, one should bear in mind that courts will require legally acceptable proof regarding the illicit transfer of the lost assets.

Individuals may be able to track some assets to some degree, using free tools.

However, to complete a successful investigation, the involvement of trained professionals is of the essence.

CNC Intelligence Inc. can track more than 200,000 digital assets, meaning that it can almost certainly track down any pilfered cryptocurrencies.

The services of such professionals cover much more than finding the destination of fraudulent transfers.

• Professional investigation management capabilities cover solutions to which only law enforcement agencies and intelligence professionals have access. One cannot match that level of sophistication through free tools. Open-source tracking tools do not show which Virtual Asset Service Provider holds a wallet. Professional investigators use law enforcement-grade, specialized software to gain access to such information.

• Certified investigators can perform professional-level cyber investigations.

• Professionals can reliably track a staggering range of digital assets. For an intelligence-based cryptocurrency forensic specialist such as CNC Intelligence Inc., almost nothing is beyond the realm of possibilities.

• The intelligence-gathering capabilities of professional cryptocurrency tracing and recovery specialists are way beyond what an amateur can ever hope to muster. These capabilities include human intelligence, open-source intelligence, cyber intelligence, as well as financial intelligence.

• Acquiring raw data is one thing. Making heads and tails of it and drawing the right conclusions is quite another. Intelligence analysis is yet another area that calls for the skills and capabilities of professional, certified investigators.

• Professional investigators such as CNC Intelligence Inc. can and do directly help law enforcement trace misappropriated digital assets. The investigators at CNC Intelligence Inc. pride themselves on being able to actively assist law enforcement agencies with active cases. If you are a member of law enforcement, please feel free to reach out to us.

• The range of digital assets that specialists like CNC Intelligence Inc. can trace is impressive. The company can trace Ether/ETH and Litecoin/LTC as well, in addition to tens of thousands of other altcoins. Positioning themselves as the silver to Bitcoin’s gold, Ether and Litecoin have drawn increasing interest from hackers and cyber thieves lately. Thus, the need to reliably track these cryptocurrencies has grown more acute.

This stage of the asset recovery process requires intelligence-gathering techniques beyond the means of a layperson.

Professional investigators can draw relevant conclusions from:

• Social media analysis.

• Public records sourcing from legal and financial databases.

• Persistent monitoring of the general- and dark web for signs of fraudulently obtained assets.

KYC Information Gathering and Identification of the Perpetrators for Cryptocurrency Tracing

To know the target(s) of your recovery efforts, you need to identify the wallets used to move the stolen funds and the people/entities to whom the wallets belong.

Following successful tracing, the crypto asset tracing and recovery specialists have to petition the relevant court to obtain KYC information from exchanges and cryptocurrency trading platforms.

Big exchanges are usually cooperative and will readily disclose KYC information if requested by any law enforcement agency worldwide, without a court order.

However, there may be exceptions.

Also, there are always uncooperative exchanges and other Virtual Asset Service Providers that will skirt the law one way or the other.

This stage of the recovery process may be costly.

Therefore, it calls for a cost-benefit analysis that takes into account the ability of the mentioned platforms to retain KYC information, based on the jurisdiction where they operate.

The intricacies of cross-jurisdictional legal action are many.

Such action requires thorough offshore legal expertise, coupled with liaising capabilities.

There are altcoin exchanges that do not gather KYC information on their users.

It is quite a cross-jurisdictional legal exercise to obtain relevant information from such platforms.

Legal action and the Initiation of Recovery Efforts

The legal intricacies and subtleties begin after the identification of the holder of the stolen crypto assets.

To recover Bitcoin, Litecoin, Ethereum, or other crypto coins, clients may have to implement a lawsuit to freeze the misappropriated digital funds.

This stage of the recovery process aims to stop the holders of stolen assets from dissipating the funds.

While it sounds simple in theory, such a legal move poses some extraordinary requirements.

• It has to prove beyond doubt that the asset holder can dissipate the funds to avoid judgment and that the risk of this happening is real.

• It also has to prove that the balance of convenience favors the plaintiff.

If we add to that a general skepticism that US and Canadian courts have expressed toward cryptocurrencies that they see as highly speculative assets, the legal picture becomes a murky and challenging one.

The legal territory concerning digital assets is continuously shifting.

The trends point toward emerging tests regarding the investigation and recovery of digital assets lost to white-collar crime, shady insolvency proceedings, and downright fraud.

In addition to being trust-minimized, decentralized, and censorship-resistant, cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and others, are global in scope.

Their users transfer them unhindered by geographical distances and borders.

While this is certainly an advantage, it is a complicating factor for Bitcoin tracing and recovery.

Investigators and recovery specialists have to navigate a patchwork of laws and perform cross-jurisdictional acrobatics.

In the UK and Australia, for example, the 2002 Proceeds of Crime Act provides solid legal ground for recovery efforts.

This law defines digital assets as “property” and “realizable property” in two of its sections.

This definition gives investigators and cryptocurrency recovery specialists a legal basis that allows them to pursue all crypto assets obtained as the result of a crime or used to launder criminal funds.

A subsequent 2019 High Court ruling has reaffirmed the mentioned definitions, thus establishing a legal precedent concerning the applicability of the 2002 POCA to crypto asset tracing and recovery.

Through its ruling, the High Court granted a proprietary injunction to help an insurance company recover a Bitcoin ransom it had paid to unknown perpetrators of a malware ransom attack.

In the US, the legal status of Bitcoin is still subject to legal wrangling.

In theory, US property law could treat digital assets like property, but there are several hurdles in the path of such recognition.

Pseudo-anonymity

The pseudo-anonymous nature of Bitcoin and other crypto coins means that the asset class may not pose a legitimate claim to “exclude others”, in the context of US property laws.

However, some US jurisdictions allow the ownership of a property through trusts, thus allowing pseudo-anonymous ownership.

What pseudo-anonymity means in this context is that in the absence of a court order, trusts do not have to disclose their beneficial owners.

For the cryptocurrency space, this means yet another battle to fight for the recognition of digital assets as property.

Numerus Clausus

Numerus Clausus is a US legal notion that the number of forms property can take should be limited and predetermined.

For instance, the law limits property forms on estates in the land to a handful, expressly forbidding the creation of other forms.

The rationale of this notion is to minimize verification costs and improve property disposition efficiency.

Based on that, it should not prove much of a hurdle for the legal recognition of Bitcoin as property.

Multi-Signatures

Multi-signatures pose a challenge to the recognition of Bitcoin as property by making it difficult to define default rules for ownership.

Specifically, such arrangements challenge the notion of “control” as a practical rule.

The more one considers the subtleties of multi-signature setups, the murkier the issue of ownership becomes.

This is, again, a tall order for US lawmakers to clarify before admitting that Bitcoin does indeed qualify as property.

Traceability

The conundrum of Bitcoin’s legal status in the US comes full circle with the limitations on its traceability.

There are indeed problems on this front, particularly in the case of serial transactions.

And interestingly, the lack of legal clarity surrounding the status of Bitcoin at present makes it more difficult for cryptocurrency tracing and intelligence professionals like CNC Intelligence Inc., to address this issue.

How Legitimate Crypto Recovery Companies Operate

The recovery phase in cryptocurrency asset retrieval is a pivotal step following the successful tracing of stolen digital funds. This stage demands a nuanced approach, blending technical expertise with legal acumen. CNC Intelligence plays a crucial role in this intricate process, collaborating closely with legal professionals to navigate the complexities of reclaiming misappropriated assets. By bridging the gap between digital forensics and legal strategy, CNC Intelligence ensures that the journey from tracing to recovery is seamless and effective.

CNC Intelligence employs sophisticated methods to gather actionable intelligence during the asset tracing phase, providing law enforcement with critical data to initiate criminal investigations and legal actions against perpetrators.

In addressing cryptocurrency theft, CNC Intelligence plays a vital role in aiding law firms representing victims. The company’s expertise in digital forensics is instrumental in providing compelling evidence and expert testimony, crucial for civil litigation. CNC Intelligence meticulously assembles a dossier of digital trails and transaction histories, furnishing law firms with the concrete evidence needed to build a strong case. Additionally, their insights are pivotal in asset-freezing proceedings, guiding legal teams through the intricacies of securing stolen assets.

CNC Intelligence’s proficiency is crucial in maneuvering through the diverse legal systems that govern digital asset ownership and recovery across various countries. By understanding the nuances of these differing legal environments, CNC Intelligence effectively facilitates the recovery process, ensuring compliance and maximizing the potential for successful asset retrieval. This expertise is essential for adeptly handling the legal intricacies inherent in global cryptocurrency recovery.

CNC Intelligence staunchly upholds ethical practices and strict legal compliance in all recovery operations, recognizing the critical importance of integrity in the sensitive realm of financial recovery. Their adherence to legal boundaries is paramount, ensuring that each step taken in the asset recovery process is not only effective but also ethically and legally sound. This commitment to legality and ethics not only fortifies trust in their operations but also safeguards the interests and rights of all parties involved.

Conclusion: Who are the best crypto recovery experts?

In the ever-evolving landscape of cryptocurrency, where the complexities of theft and fraud are increasingly intricate, CNC Intelligence stands out as one of the best recovery experts for cryptocurrency, CNC Intelligence embodies a blend of technical prowess and legal acumen, essential for navigating the treacherous waters of digital asset recovery. Their role transcends mere investigation; it is about restoring what is rightfully owed to victims of cyber theft.

With a team that expertly wields cutting-edge tools for tracing digital assets, CNC Intelligence delves deep into the digital footprint left by illicit transactions. This high-level expertise is critical in providing law enforcement with actionable intelligence, laying the groundwork for initiating criminal investigations and subsequent legal actions. Their work is a testament to the power of combining technology with justice.

When it comes to working with law firms, CNC Intelligence takes on a role that is both collaborative and guiding. Their proficiency in digital forensics equips them to offer compelling evidence and expert testimony, becoming an invaluable ally in civil litigation. Their meticulous approach in assembling transaction histories and digital trails empowers law firms, enabling them to build strong, convincing cases for their clients. Moreover, their strategic insights are pivotal in asset-freezing proceedings, a crucial step in preventing the dissipation of stolen assets.

Navigating the global maze of legal systems, CNC Intelligence showcases its unparalleled expertise in both domestic and international legal frameworks. This capability is not just about facilitating recovery; it’s about ensuring legal and ethical compliance every step of the way. Their commitment to ethical practices is unwavering, recognizing the delicate nature of financial recovery and the importance of maintaining the highest standards of integrity.

CNC Intelligence’s role in the realm of cryptocurrency recovery is both vital and commendable. Their collaborative approach with law enforcement and legal firms, combined with their profound understanding of both the technical and legal nuances of asset recovery, positions them as one of the best recovery experts for cryptocurrency. With CNC Intelligence, victims of cryptocurrency fraud have a fighting chance to reclaim their digital assets and restore their faith in the security of the digital economy.

Bitcoin & Cryptocurrency Tracing Bottom Line

To recover cryptocurrency, slighted parties need to adopt a well-coordinated, intelligent, and cautious approach.

Such an approach calls for specialist skills and know-how far exceeding the capabilities of individuals, regardless of their level of expertise.

We offer complimentary consultations to determine if our Asset Tracing, Recovery Assistance, and Intelligence Services are suitable for your case.

When you comment, your name, comment, and timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.

Hello…. I’ve lost over 37000USDT to scammers. My life savings taken from my wallet. I’ve been removed from the family home as this has triggered my PTSD, which I developed from my time in the military. Now resigned to living in a room. Life is not good. Do you have a 100% success rate that I will get my money back into my Coinbase account?

Please schedule a free consultation with us to learn if and how we can help you recover your funds: https://cncintel.com/consultation/.

I clicked this link to go into a Dapp:

dexscreenerai.netlify.app

Then I clicked connect wallet. As soon as I clicked this , £1200 from my trust wallet was taken in ETH. The address it was sent to was this: 0xe9a2990f54cd2a58fdbbb361794f27cd788c8622

Please help me restore it.

Hello,

We’re sorry to hear about your unfortunate experience. It seems like you may have interacted with a malicious dApp that led to the loss of funds from your Trust Wallet. As a cryptocurrency tracing and investigation firm, we can help you analyze this transaction and provide you with the information and resources necessary to potentially recover your lost funds.

We highly recommend scheduling a free consultation with us to discuss the details of your case. Our team of experts will evaluate the situation, provide guidance on the next steps, and work with you to explore possible recovery options. To get started, please visit our website and book a free consultation, or reach out to us via email or phone.

We understand the urgency of the situation and are committed to doing our best to assist you. Don’t hesitate to get in touch with us so we can start working on your case immediately.

Best regards,

CNC Intelligence

I have lost approx 4500 USD recently to a scam, is possible to recover this.

We’re sorry to hear that you fell victim to a scam and lost your hard-earned money. We understand that it can be a distressing experience, and we would like to help you in any way we can.

We would be happy to schedule a free consultation with you to discuss your situation and explore if we can help you. During the consultation, we will provide you with an overview of our services, discuss your options, and provide you with a quote for our services.

Best regards,

CNC Intelligence

After reading your insightful article on cryptocurrency tracing and recovery, I’m curious about a specific technical aspect of the process. How does CNC Intelligence handle the challenge of tracing cryptocurrencies that have passed through mixers or tumblers? These services are designed to obfuscate the trail of digital currency transactions, making it more challenging to track the flow of funds. What methods or technologies does your team employ to effectively trace assets that have been subjected to these anonymizing processes?

CNC Intelligence handles the challenge of tracing cryptocurrencies that have passed through mixers or tumblers by leveraging evolving technology and the nature of blockchain itself. Firstly, it’s important to note that the use of mixers has significantly declined in recent times for various reasons. However, when dealing with transactions that have been mixed or tumbled, CNC Intelligence employs techniques to demix these transactions. This involves unraveling the complex layers created by the mixing process. Moreover, the tools and methods used by our investigators are constantly being improved. Given that the blockchain is an immutable ledger, this continual advancement in technology offers the potential to trace through mixers or tumblers more effectively in the future. Even if tracing is challenging at the moment of mixing, the persistent evolution of our methods keeps the door open for future breakthroughs in tracing such transactions.

I was introduced to crypto trading by a friend who has since vanished and left me clueless on how to recover my BTC from a website called OEXBAKE.com. I managed to make just by virtue of learning and trying out a whopping 1951.8591 in btc. Now they are refusing to let me withdraw into my wallet in coinbase by saying I need to prepare 1% of the totality of the assets in my wallet i want to recieve to and transfer to a one time address that will be provided to me. once they recieve this they will allow the relevant transfer.

Can you please hep me recover the btc.

We will contact you as soon as possible to discuss your situation further. In the meantime, you can also schedule a consultation with us by visiting https://cncintel.com/consultation.

Hello, I`m working in KDIC(Korea Deposit Insurace Corporation) and I`m interested in your business. We are tracing assets of debtors. We have the athority of require indenty information in Korea and we partially have identy information in USA and other countries. We want to know we can request to find cripto assets with information we have now.

Hello,

Thank you for reaching out to us at CNC Intelligence. We appreciate your interest in our cryptocurrency tracing services. Given the unique position and authority of the Korea Deposit Insurance Corporation (KDIC) in requiring identity information in Korea, and your partial access to identity information in the USA and other countries, we believe our services could be highly beneficial to your asset tracing efforts.

Our team specializes in assisting law enforcement agencies and law firms with cryptocurrency tracing, leveraging advanced analytics and forensic techniques to uncover the movement of digital assets. We utilize tools from Blockchain Intelligence Group, Chainalysis, and TRM Labs to deliver actionable intelligence tailored to each case.

Considering the information you currently have, we are confident that we can assist you in tracing cryptocurrency assets. Our process involves an initial consultation to understand the specific details and requirements of your case. This allows us to tailor our solutions to meet your needs effectively.

We invite you to schedule an initial consultation with us through our website at https://cncintel.com/consultation/ to discuss how we can assist KDIC in tracing the assets of debtors. Our team is ready to provide you with the expertise and support needed to navigate the complexities of cryptocurrency investigations.

We look forward to the opportunity to work with the Korea Deposit Insurance Corporation.

Best regards,

The CNC Intelligence Team

Dear Sir,

I found your web page by browsing through my internet looking for a recovery fund company, I happen to come to see yours.

I start investing this year in February looking for a passive income, I felt into a page saying I can start investing with 250 pounds, so I register and the next thing was, I got a call from a broker working for fxa Trade. At the beginning they asked me to invest more but I told them I do not have much cash. Within a few weeks, my investment gain a few thousand pounds and I was amaze, They contacted me again and say, the market is good and I should invest more, I told them they can invest with the gain that I made. After a few months, I make 10 over thousand pounds to 20 over thousand pounds and in June, I have 114000 pounds. They called me to withdraw my fund, I was explain by the broker that fxa Trade is closing their office, to withdraw my fund I have to pay my CGT which is 10 percent of my gain. They asked me to open an account with WISE, I did and they say I can transfer money into my Wise account and pay for my CGT, so I transfer money from my UK bank account to Wise account. they assist me to transfer the fund to them, they asked me to transfer in 3 part, which I did. They say I should receive my fund within 24 hours. I waited for 24 hour and check my account and I don’t see any transaction coming in my account, so I write to my broker and asked why I did not receive my fund, he explained that my UK bank refused to accept the transaction. So I asked them to pay back my CGT, they say they have added it into my wallet and that they can’t take it out. So I asked them how could I get my fund, they say they have transfer my fund to Metamask. I try to withdraw from Metamask and was asked to pay CGT to withdraw my fund. I know then I was being scammed. They have took almost 12 and half thousand pounds from me and my fund is stuck in Metamask. I wonder if you can help me take it out. Unfortunately I am completely broke, I live day by day eating little and can’t pay my rent etc. If there is a front payment for your service I can’t afford at the moment, Wonder if you have any solution to help me please.

Hope to hearing from you

Best Regards

Thomas

Hi Thomas,

Thank you for reaching out to us and sharing your situation. We’re sorry to hear about your experience with FXA Trade and the difficulties you’re facing.

Please schedule your consultation through our website at https://cncintel.com/consultation/. During this consultation, we’ll gather more information and provide you with tailored guidance on the next steps.

We look forward to assisting you.

Best regards,

The CNC Intelligence Team

Nice

Ive lost 200,000usd from a USDT liquidity mining pool ,Ethdma.de It happened over 4 months from October 2024-January 2025. Every time I want to withdraw funds they ask for mining for linking the dApp ,to provide insurance for the safety of funds ,for signing up for VIP service so I can get the funds. Im out of all liquid funds and need my money back to pay back taxes,and people Ive borrowed money.

Dear Kenneth,

Thank you for reaching out. We understand how distressing this situation is. Based on your description, it appears that you have been targeted by a sophisticated scam. Our team specializes in cryptocurrency tracing and investigative services to help identify potential recovery options.

If you would like one of our investigators to reach out to discuss your case in more detail, please schedule a free consultation at cncintel.com/consultation.

Best regards,

Ben

CNC Intelligence